|

Category: Uncategorized

1 in 5 American Homes have been Burglarized.. Are You at Risk?

I remember coming home on a weekday afternoon a couple of years ago and finding an unknown SUV parked in front of my barn and the side door of the barn hanging open. Within seconds a man ran out of the barn, hopped in the truck, and drove off. There’s no telling what he might have made off with had I not come home early that day. I was fortunate. But it opened my eyes.

Home invasions can cost homeowners more than just their valuables, but their peace of mind and sense of security, too. I know.

And according to a new report, experiencing such a traumatic event is much more likely than many may think.

The newly released 2017 Ooma.com home security report found that 63% of American homes are at high risk of burglary.

The data scientists at Ooma.com surveyed 1,000 Americans about how they protect their homes when they’re away and also found that 16% of Americans say they’ve experienced a burglary. These victims identified the factors they say they believe contributed to or caused their home invasion.

Here are the top five factors putting American homes at risk:

No. 5: Living in an apartment building

Of the 16% of Americans who say they have experienced a burglary, 7% say living in an apartment building put them at greater risk. Apartments can be more accessible targets for thieves for a few reasons, mainly due to easier access.

Fire escapes or sliding side doors can provide thieves with easy entry if not secured properly. There’s also an anonymity factor, where burglars could potentially walk through an apartment complex appearing to others as a resident. The significantly smaller size of an apartment compared to a home also makes it easier for thieves to cover more ground in a shorter amount of time.

In addition, renters experience a burglary at nearly double the rate of homeowners, according to the Bureau of Justice Statistics.

No. 4: An open window

Eight percent (8%) of burglary victims say an open window was the cause of their attack. Ooma.com’s home security report found that 60% of Americans leave their windows open when they’re away, putting the majority at risk. Of that 60%, approximately 15% say they simply forget to close their windows, and another 15% say they leave their windows open in warmer weather.

No. 3: An unlocked door

Forty-two percent (42%) of Americans say they leave their doors unlocked when they are away from home. Some say they plan to return quickly (14%), and others say they just forgot (12%). As the number three-factor, 14% of burglary victims attribute their robbery to an unlocked door. Supporting this claim, data collected from a 2012 FBI Crime Report says 34% of burglars enter through the front door.

No. 2: No home security system

As the number two factor, 16% of burglary victims say not having a security system puts them at risk. According to Oooma.com, only 37% of Americans own a security system, putting 6 in 10 U.S. homes at risk. According to the FBI, homes without security systems are up to 300% more likely to be broken into.

No. 1: Neighborhood or surroundings

Nearly 24% of Americans burglarized say their neighborhood or surroundings put them at greater risk. Besides taking basic safety precautions like locking doors and windows, there are other ways to make your home less of a target.

Experts suggest adding more lights in and around your property to deter burglars. Keeping the lights on inside will make it harder to tell if anyone is home, and more exterior lights will make it easier for would-be thieves to be seen.

Five Ways You Can Defend Your Small Business Against Fraud – NOW!

I have worked with many small business and family-owned businesses in my 27 years as a professional insurance agent. I’ve certainly learned that trust and loyalty are desirable traits in a small business; however, these traits can also leave a small business vulnerable.

In fact, small businesses are especially vulnerable to fraud, according to the Association of Certified Fraud Examiners (ACFE) 2016 Global Fraud Study. The study found that businesses with fewer than 100 employees, which are in many cases family-owned, experience fraud at a rate of 28.8%, compared to the 19.8% experienced by those with more than 10,000 employees.

In a small business, trust and security often have an inverse relationship, meaning as trust increases in a business, the quality of internal controls and security is minimized. Business relationships — particularly among family members — can become strained when individuals believe they are owed more money or authority than they receive.

Personal financial pressure and emotional stress outside the business can also create tension within an organization. In worst-case scenarios, most employees know there is little risk of exposure, and the perceived benefits of financial fraud outweigh these risks.

When family members and employees are suspected of fraud within the business, they may not be held accountable due to the dynamic of a close-knit work environment. Especially family members, who may be more hesitant to report relatives to authorities, seeking to save the family member from jail time or the embarrassment that ensues.

Of course, smaller companies suffer more when fraudulent activity occurs. It’s more difficult to control the damage in a $5 million company than in a $250 million company. Misappropriated money often makes a greater impact, and the damage is experienced throughout the entire organization, affecting company culture. While a perpetrator in a large organization may be viewed as a singular “bad egg,” one in a smaller business can be viewed as an institutional problem or part of ongoing corruption to other employees.

According to the study, the median fraudulent loss of $150,000 suffered by small organizations was the same as the fraudulent loss experienced by large organizations. However, in a smaller company, that loss represents a significantly larger percentage of the company’s overall value. The number demonstrates the enhanced responsibility and trust often granted to individuals within a smaller company, leading perpetrators to believe they can take more with little risk of exposure.

Establishing effective controls

When personal and professional interests collide, the best approach to maintaining success and prosperity, from both familial and financial perspectives, is to implement and strictly enforce effective internal controls.

Five ways to enforce internal controls include:

1. Segregate financial duties. Corruption involving check tampering, skimming, payroll, and cash larceny schemes are twice as common in small organizations compared to larger organizations. One employee alone should never control the entire business’ finances. A simple solution is to create a three-person system of checks and balances: one person opens the bank statements, one prepares the bank reconciliations, and a third person reviews all transactions and canceled checks.

2. Avoid signature stamps for checks. A small business should consider requiring two signatures for any payment over a certain monetary amount.

4. Give more employees an understanding of financial reporting. Even if employees claim to not be “numbers” people, it’s important that all staff are aware of financial reporting and are making an effort to understand the business’ finances. To increase transparency and provide another level of security, outsource your financial reporting and ensure someone is monitoring for fraud.

Trust is not an internal control

When confronting fraud in a family business, family loyalties or dynamics must be set aside. Even in small businesses, the most common way fraud is detected is through anonymous tips. Organizations with fraud hotlines are more likely to detect fraud compared to those without, at a rate of 47.3% compared to just 28.2%.

Appropriate punishments should be considered in advance and decided upon by multiple employees. Then, companies must follow through on those punishments. The ACFE study found that 40.7% of companies choose not to involve law enforcement due to either fear of bad publicity or the desire to remain loyal to the perpetrator. Decision-makers should maintain a zero-tolerance policy for uncovered fraudsters, as an effective deterrent against copycats.

Another measure a business can take to mitigate the damaging effects of fraud is to work with their insurance provider to ensure their plan includes coverage and protection from employee dishonesty. Outside investigative fees are difficult to estimate due to the number of layers that could be in play in any investigation.

A business should explore purchasing an insurance rider to cover costs of fraud investigations and potential legal fees, as well as the cost of financial loss incurred by the fraudulent activity. In any case, fraud prevention is a much more cost-effective safeguard than reactive damage control.

Fraud can happen anywhere

The more you believe it can’t happen in your business, the more susceptible you become to it. Most fraud perpetrators are first-time offenders and are well-standing employees in the company, resulting in greater access to controls and the belief they won’t get caught. Family businesses’ increased susceptibility is an essential reason to defend against fraud with multiple internal controls and external resources.

For more tips and resources on defending your business against fraud, contact your local law enforcement agency or financial adviser.

SOURCES – MARK GOODWIN, NATIONAL UNDERWRITER PROPERTY & CASUALTY, BILL KOWASKI, REHMAN CORP INVESTIGATIVE SERV

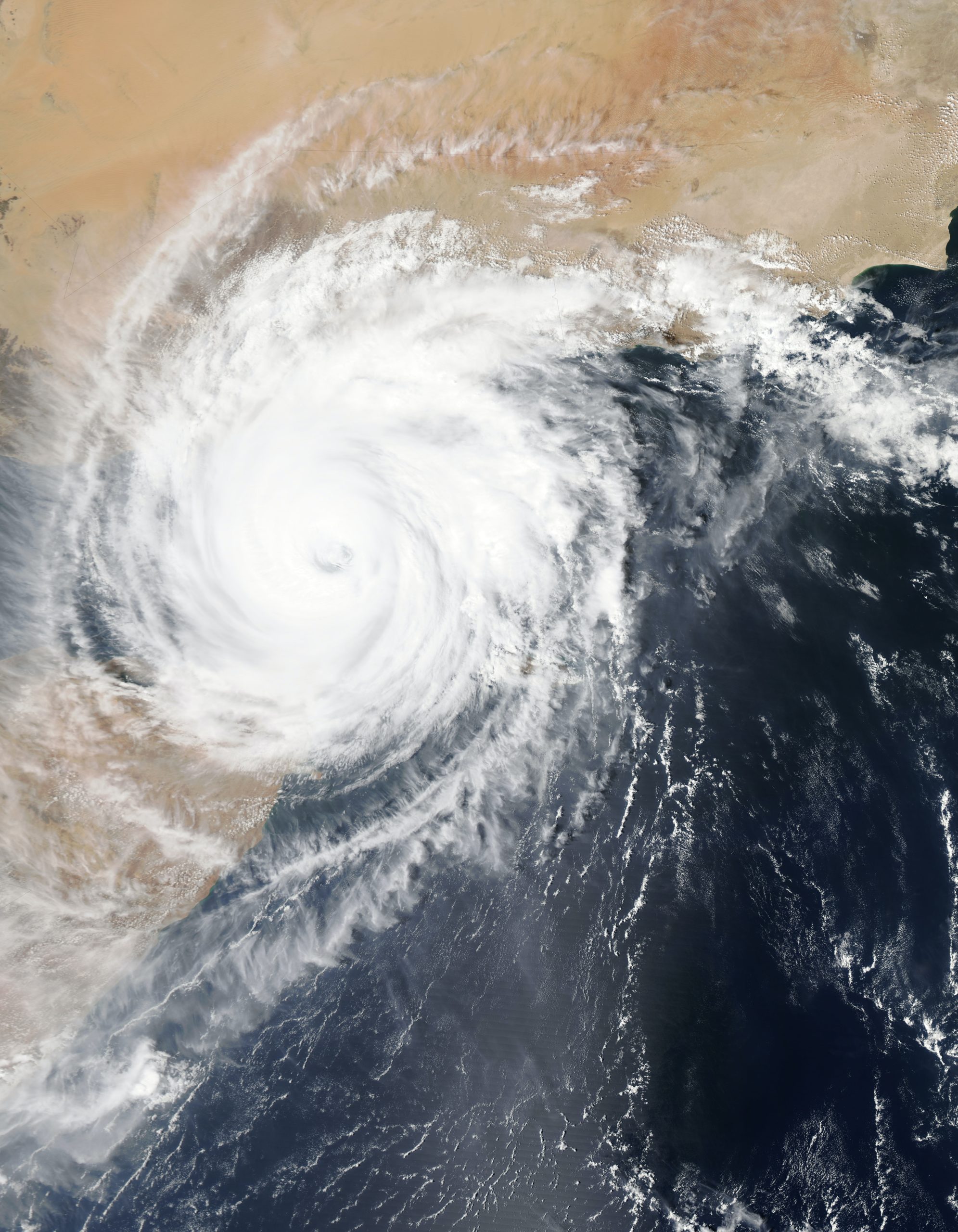

Insurance Tips following Hurricane Harvey

Like you, I have been watching the news about Houston, Hurricane Harvey, and now Irma. It’s looking like this hurricane season will be the most expensive one of all time – topping the $15billion in losses that FEMA experienced in Louisiana and Mississippi. We will not know the extent of the damage for some time as the storm moves, the waters recede and the damage is uncovered. It is heartbreaking to see the loss that so many people must endure.

A Homeowner Insurance Policy will cover many types of claims – wind, rain, hail, vandalism, and more….but a standard policy will not cover flood damage from overflowing rivers and streets.

Flood coverage is usually purchased on a stand-alone policy from the National Flood Insurance Program administered by the federal government. Just about any property and casualty insurance agent can procure a flood policy with the NFLIP. NFLIP is anticipating approximately 150,000 claims from Hurricane Harvey for flood damage and Irma may add significantly to that. There will likely be another 50,000 claims for wind and rain damage that standard home insurance policies will likely pay for Harvey and more for Irma.

Sadly, there are estimates that less than 20% of the homes damaged by the flood will have a flood insurance policy to help pay for the damage..many people will be left on their own to pay for their flood-related losses.

According to FEMA the average flood claim typically ranges from $10,000 to $42,775 with a Flood Insurance Policy costing from $650 to $1500 per year.

The first 5 months of 2017 show the average claim payment for a flood loss has been $24,698. It has been estimated that 52% of the homes and buildings in the Houston metro area are at a “high” or “moderate” risk of flooding. These statistics may get worse as we go through these 2 hurricane disasters.

For people with flood damage it is important that they document their damage – written is ok, video and digital pics are preferred. They should file their claim as soon as they are able.

WHAT DOES FLOOD INSURANCE COVER?

Flood insurance can cover both the building and contents…but like typical property insurance, it does not cover the land. Coverage for basements, crawl spaces, and lower floors may be limited.

The dwelling coverage can cover property up to $250,000 and contents up to $100,000 The flood policy does not give guaranteed replacement like some home insurance policies do. It will only pay up to the amount of insurance described on the declaration page.

Building coverage includes:

- Building and Foundation

The electrical and plumbing systems, major systems like central air conditioning equipment, furnaces, and the hot water heater - Som e appliances such as refrigerators, cooking stoves, and built-in appliances like dishwashers

- Permanently installed carpeting over an unfinished floor

- Window Blinds

- Permanently installed paneling, wallboard, bookcases, and cabinets

- A detached garage – up to 10% of the building coverage

Contents Coverage Includes:

- Clothing, Furniture and Electronic equipment

- Curtains

- Portable and window air conditioners

- Portable appliances such as microwaves and dishwashers

- Carpeting that is not covered under the building coverage

- Clothes washers and dryers

- Food freezers and the food in them

- Certain valuable items such as original artwork and turns – up to $2,500

WHAT DOESN’T THE FLOOD INSURANCE COVER?

there are a number of things that a flood insurance policy will not coverage including:

- Currency, precious metals, and valuable papers like stock certificates

- Damage caused by moisture, mildew, or mold that could have been prevented by the homeowner or renter

- Property items outside of the dwelling such as trees, plants, wells, septic systems, walkways, decks, patios, fences, hot tubs, seawalls, and swimming pools

- Financial losses due to business interruption or loss of use of the insured property

- Most self=propelled vehicles – cars, motorcycles, four-wheelers, etc.

- Damage from sewer backups unless there is a flood in the area and the flood is the proximate cause of the sewer or drain backup

YOU WANT TO FILE YOUR FLOOD CLAIM AS SOON AS POSSIBLE!

Individuals or businesses with a flood insurance policy should file a claim as quickly as they can if they sustain flood damage. Since there has been an official Presidential Disaster Declaration, homeowners may be eligible for assistance from other sources such as FEMA, the U.S. Small Business Administration, or even some state or private organizations.

Residents who register for disaster assistance may be able to get help for temporary housing, funds for home repairs, and help with home replacement or permanent housing construction.

When you call to make your claim be sure to have your policy number, the name of the agent you bought the policy through, and your contact information. Give your cell, email, and where you can be reached regarding the claim. Keep careful notes about who you spoke with and what was said.

KEEP CAREFUL DOCUMENTATION

Make a list of your damaged items and if you can, include where and when they were purchased and their cost. Online vendors may be able to provide receipts for your purchases. If you have photos of items prior to the storm have them available for your claim adjuster.

Be sure to document any items that you have discarded, need to be disposed of, or placed outside of the home or office.

Keep all copies of estimates from contractors, any expert’s reports, or other documentation related to the cost of the claim. If your claim is denied or there are questions about coverage, having a record of what was lost or the cost to repair the damage will be helpful in appealing the decision.

Take pictures of large ticket replacement items that are purchased such as televisions, appliances as well as the receipts as proof of purchase. The more documentation you have, the easier it will be to substantiate your claim.

FINALLY, BEWARE OF FLY BY NIGHT CONTRACTORS

Sadly, there are many unscrupulous people who will take advantage of a disaster to fleece you of your money. Before engaging any contractor be sure to check them out. Ask for references and proof of insurance. Look for online reviews. Do they have a website? Do they have a FB page? Are they registered with the BBB? The old adage – “If it sounds too good to be true…it probably is” applies.

Be careful.

I just got a moving violation!!! Now What?

A moving violation ticket will leave a bitter taste in any driver’s mouth. I know…I’ve had them. So have a lot of my clients.

A violation can spike a driver’s auto insurance premium. Plus it may come with hefty financial penalties. But depending on the violation or which state the driver is located in, it could be extremely burdensome on a driver’s wallet.

A recent Quadrant Information Services study found car insurance premiums can climb by as much as 96% after a single moving violation on average nationwide. Ohio is not nearly as punitive as some states.

The Type of Violation Makes a Big Difference in the Potential Insurance Rate Increase

The study analyzed the average national premium increase for one moving violation in 21 different categories, including careless driving, reckless driving, driving under the influence, and speeding. As in years past, the study found the economic impact on one’s insurance premium varies significantly among different types of violations and among different states.

Here are some of the study’s key findings along with some advice on what you can do after a moving violation to keep your rates as low as possible:

Your premium increase will depend on the specific violation.

Take, for instance, the difference between reckless and careless driving.

According to Robert Nevo, a former Georgia police officer and current owner of Nevo Driving Academy, careless driving is usually defined as “a minor lapse in judgment,” such as following too closely to the vehicle in front of you. Reckless driving, however, concerns more “intentional acts,” such as driving in a way that shows no regard for the safety of others. A Reckless Driving citation can have severe consequences.

“Moving violations are typically weighted with a point system. This makes an excessive speeding violation much more severe than, say, a broken taillight violation,” said Nevo. “Insurance companies often see more points against a driver’s license as an increased risk. Therefore, you’re going to see higher premiums for that driver.”

Whether it’s a minor or major offense, your wallet will feel the toll.

According to the National Association of Insurance Commissioners (NAIC), the average annual U.S. auto insurance premium is $866. That means an 88% premium spike for one reckless driving offense will result in an increase of just more than $750 per year.

Even relatively “minor” infractions, such as following too close or not yielding to a pedestrian, can mean paying an average of $260 more per year for car insurance. Driving under the influence carries an expensive insurance penalty, with a single infraction resulting in an average premium spike of $1,086.

You can still save money.

While your premium may be impacted for quite some time, the moving violation will eventually be erased from your driving record. How long you’ll feel the increased premium’s impact depends on the severity of the violation as well as the individual state laws. Here are some tips for the bumpy times ahead.

Seek forgiveness:

If this your first moving violation, especially a minor one such as a failure to signal, talk to your auto insurer. They’re typically going to be somewhat forgiving for a small infraction. Take advantage of any driving classes your state might be offering to remove one or two moving violations from your record.

You can buy “Accident and Violation Forgiveness” as part of your auto insurance policy. You must buy this endorsement BEFORE the accident or violation of course.

Make a deal:

If your violation isn’t too severe, look for a plea bargain when your day at traffic court is due.

Use an Independent Insurance Agency:

Independent agents have multiple insurance companies to shop for a new car insurance policy.

Wait it out:

Eventually, your driving record will go back to its original clean slate, but that could take anywhere from three to five years.